Artificial intelligence (AI) is continuously pushing the boundaries of what’s possible, and OpenAI’s latest models are no exception. Among them, the flagship GPT-4.1 is not just another incremental improvement; it represents a significant leap in reasoning, speed, and context capabilities. Alongside it, models like o4-mini and o3 aim to meet specific needs for efficiency and affordability.

But how does this tie into the evolving world of video creation? More specifically, what do these advancements mean for the future of tools like text-to-video generators, content curation, and video marketing strategies? This blog explores the implications of OpenAI’s new advancements and how they could revolutionize video in the digital age.

What Are OpenAI’s New Models?

OpenAI’s new portfolio includes three major breakthroughs designed for diverse applications. Below are some highlights of their features and intended use cases.

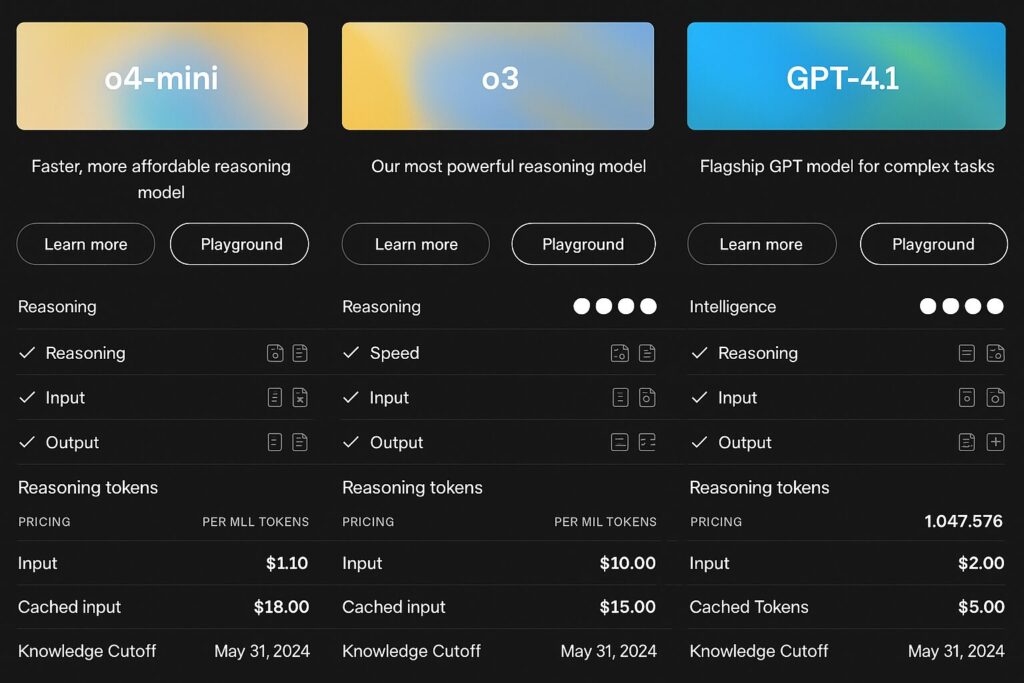

1. o4-mini

Purpose: Affordable reasoning model

- Key Features:

- Exceptional speed for fast computations

- Reduced cost model ($1.10 per 1M input tokens)

- Smaller token window of 200,000

- Ideal For:

- Quick, cost-effective tasks without compromising on quality

2. o3

Purpose: Powerful reasoning capabilities

- Key Features:

- Designed for computationally intensive analysis

- Premium pricing ($10.00 per 1M input tokens)

- Robust outputs for more sophisticated tasks

- Ideal For:

- Enterprises seeking powerful AI tools for research or business solutions

3. GPT-4.1

Purpose: Flagship model for complex tasks

- Key Features:

- Ability to process larger tokens windows (1,047,576 tokens)

- Exceptional reasoning with resource optimization ($2.00 per 1M input tokens)

- Comprehensive output versatility

- Ideal For:

- Solving more intricate and demanding use cases

The addition of models like GPT-4.1 shows OpenAI is focusing on building robust, adaptable solutions for existing and new industries. One key domain likely to benefit tremendously is video creation.

AI Video Models in Focus

Video has emerged as a leading content medium, with platforms such as Epso.ai already utilizing AI to create powerful text-to-video technology. OpenAI’s new releases will raise the benchmark even higher and add ai video upscaling to the list of improvements. Below are some anticipated transformations we can expect in video creation.

Faster Text-to-Video Generation

OpenAI’s enhanced reasoning and processing capacity will significantly speed up tools that rely on text-to-video technology. For instance, platforms like Epso.ai can use reasoning-focused models like o4-mini or GPT-4.1 to convert complex scripts into detailed visuals in mere minutes. Video creators will produce more content with less effort, ideal for social media managers, marketers, and influencers.

Improved Customization

With a larger token window, models like GPT-4.1 allow creators to input more complex scripts with context, enabling fully customized video creation with ease. This could extend to options like personalized branding or dynamic effects designed specifically for individual styles or industries.

Enhanced Visual Results

AI-generated videos will have the ability to embed not just text but intelligently generated commentary aligning various elements such as graphics, pacing, or animation styles. This integration will make storytelling through video dynamic, vivid, and more engaging than ever.

Transforming Niche Industries

Text-to-video capabilities built on advanced AI models could revolutionize how niche industries deliver services, including education, entertainment, and healthcare. Professors could create lectures with visual aids in minutes, or healthcare professionals might use adaptive video technologies to build patient tutorials.

Why These Advancements Matter for Marketing

Marketers increasingly rely on video to engage audiences, with studies showing that 91% of businesses see video as an essential marketing tool. OpenAI’s models could redefine marketing outcomes while aligning perfectly with the speed and precision businesses need.

Smarter Personalization

Personalized videos for marketing campaigns have higher engagement rates because they tend to resonate with audiences better. Using models like o3 or GPT-4.1, brands can intuitively analyze customer behavior and preferences, generating videos tailored to meet individual needs.

Automating Video Content Distribution

Pairing content distribution with AI-driven selection will ensure brands place their videos where they’re most likely to succeed. For example, tools like Epso.ai may soon be able to harness OpenAI’s capabilities to recommend the platforms and demographics where the video performs best.

Augmenting Global Outreach

OpenAI models support multimedia script generation across languages, widening the audience reach of video projects. Businesses can transcend borders without needing extensive translations or localization efforts.

Challenges on the Horizon

Even as AI transforms industries like video creation, these technologies also bring challenges. Key issues include the ethical application of content creation, preserving creative originality, and maintaining human oversight in automation-heavy workflows.

While advanced reasoning models reduce errors, they cannot yet fully emulate emotional depth or cultural subtleties in storytelling. These facets are crucial for video creators who aim to evoke emotion.

Creatives and businesses must therefore balance leveraging OpenAI’s AI innovations with maintaining a human touch for authenticity to create meaningful results.

Key Takeaways

The release of OpenAI’s GPT-4.1 and sister models represents a breakthrough in AI reasoning and processing power, introducing unparalleled opportunities for industries that rely on content creation. Specifically, video creators, marketers, and enterprises stand to gain through faster workflows, better customization, and wider-reaching campaigns.

Whether you’re an independent creator or part of an enterprise team, tools like Epso.ai will integrate OpenAI innovation to drive impactful and efficient content strategies. Step into the future of AI-driven creativity and explore how it can revolutionize your video content.